Streamline Compliance with Smart E-Invoicing

Revolutionize tax documentation with our e-invoicing dashboard featuring automated IRN generation and GST compliance. Our system handles bulk e-invoice processing while providing real-time IRN status updates. Manage complete workflows including credit note management, invoice cancellation, and e-invoice reconciliation - all with a signed invoice archive and detailed cancellation audit log for full transparency.

Simplify Compliance with Our E-Invoicing Suite

- E-invoicing dashboard providing real-time IRN status updates and GST compliance alerts

- Automated IRN generation with bulk e-invoice processing capabilities

- Complete credit note management integrated with e-invoice reconciliation

- Audit-ready invoice cancellation with detailed cancellation audit log

- Tax invoice analytics with signed invoice archive for all transactions

- Seamless ERP integration supporting end-to-end credit note workflow

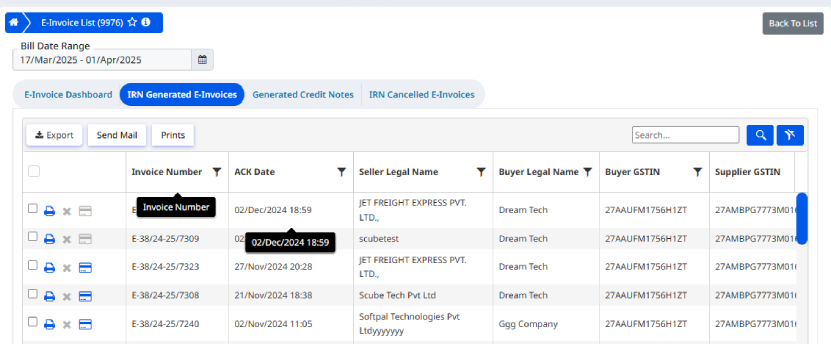

IRN Generated E-Invoices - Complete GST Compliance Solution

Streamline tax documentation with our e-invoicing dashboard featuring automated IRN generation and instant GST compliance validation. The system processes bulk e-invoice submissions while providing real-time IRN status updates through every step - from creation to signed invoice archive.

Seamlessly manage credit note workflow and invoice cancellation with complete cancellation audit log trails. Our e-invoice reconciliation tools automatically match transactions with tax invoice analytics for accurate financial reporting, while native ERP integration ensures data consistency across all platforms.

Automated GST compliance checks for error-free invoicing

Complete credit note management with reversal tracking

ERP integration for seamless data synchronization

Instant IRN generation with QR code embedding

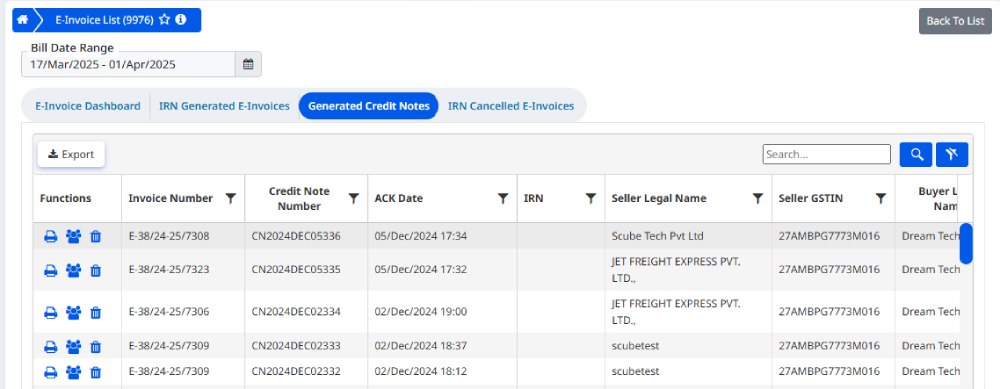

Automated Credit Note Management with IRN Compliance

Streamline returns and adjustments with our credit note management system integrated with the e-invoicing dashboard. Automatically generate GST-compliant credit notes with IRN generation for all returns, linked to original invoices for seamless e-invoice reconciliation. Our system maintains a complete signed invoice archive including all credit notes with real-time IRN status updates.

The end-to-end credit note workflow supports bulk processing via bulk e-invoice operations, while ensuring full GST compliance throughout the reversal process. Detailed cancellation audit log tracks every adjustment alongside comprehensive tax invoice analytics for financial reporting.

Seamless ERP integration for accounting synchronization

Audit-ready cancellation audit log with reason codes

Complete invoice cancellation and reversal tracking

Automated IRN generation for all credit notes

IRN Cancelled E-Invoices | Complete Cancellation Management

Maintain full GST compliance with our comprehensive invoice cancellation system integrated with the e-invoicing dashboard. Manually generate cancellation requests with proper IRN generation protocols, while maintaining a detailed cancellation audit log for all voided transactions. The system enforces GST compliance rules during cancellation and provides real-time IRN status updates.

Seamlessly manage cancellations alongside credit note management and e-invoice reconciliation workflows. Our solution supports bulk e-invoice cancellations with automatic updates to your signed invoice archive, while tax invoice analytics track cancellation patterns across your ERP integration.

Complete cancellation audit log for compliance reporting

Automated invoice cancellation with IRN validation

Real-time updates across e-invoicing dashboard

Synchronized updates to credit note workflow